Quantitative Trading Bootcamp

Coming soon to a city near you! Conditional on you living near Berkeley or NYC

I recently went on Patrick McKenzie (patio11 on the internet)’s new podcast, Complex Systems, to talk about my trading bootcamp. It was a blast — we could have easily kept talking for another 10 hours — and we got a lot of feedback of the form “did you… intentionally speed up the audio?” so you know it was really me.

We recorded the podcast while I was in the middle of teaching a hyper-condensed two day version of the bootcamp during Manifest Summer Camp. Two days is not enough time to teach even the very basics of trading, and meant I didn’t get to give nearly as much personal attention and feedback to each student as I would have liked, but many of them enjoyed it nevertheless, and one even wrote a blogpost about it.

More importantly, I enjoyed it a ton, so I’m planning to run a couple more — one in Berkeley August 19-22 2024 and one in NYC September 2-5 2024. I’m especially excited for some additions to the infrastructure and curriculum, like a new electronic exchange that a Manifest bootcamp student recently coded up for it, and a trading-tools-hackathon where students build spreadsheets and webapps to monitor market conditions and alert them to profitable trades for the course’s final trading competition.

In Ricki style, the registration pipeline is “fill out a janky google form and then I’ll send you a payment link,” which narrowly beat out “wait until you’ve finished setting up a fancy website and ticketing platform to run the course.”

Lighthaven Trading Bootcamp (August 19-22, Berkeley)

The August session will take place at the ever-marvelous Lighthaven Campus, in Berkeley, California. The venue is exquisite, magnificently operated, well stocked with delicious and nutritious snacks, full of fun side passageways and secret rooms, puzzle-hunt-perfect, usually a reasonable temperature, and anyone who contributed to its creation must be wise beyond their years.1 Unfortunately it’s also understandably oversubscribed, so they don’t have a ton of space for me, and I expect there to be a lot more demand for the course than available spots.

Fortunately markets have solved this problem, and I can just charge more than I would if I didn’t have venue-imposed space constraints. But I’ve never charged directly for trading bootcamp before (I’ve now run it eight times, always under an existing program paying me a flat rate) and I have a lot of uncertainty about the optimal rate to charge. I also want to encourage people to sign up sooner so I and the Lighthaven team can plan for space needs with more advance notice, and August 19 is pretty soon. So I’m doing something kinda weird and experimental with pricing.

Weird experimental pricing scheme

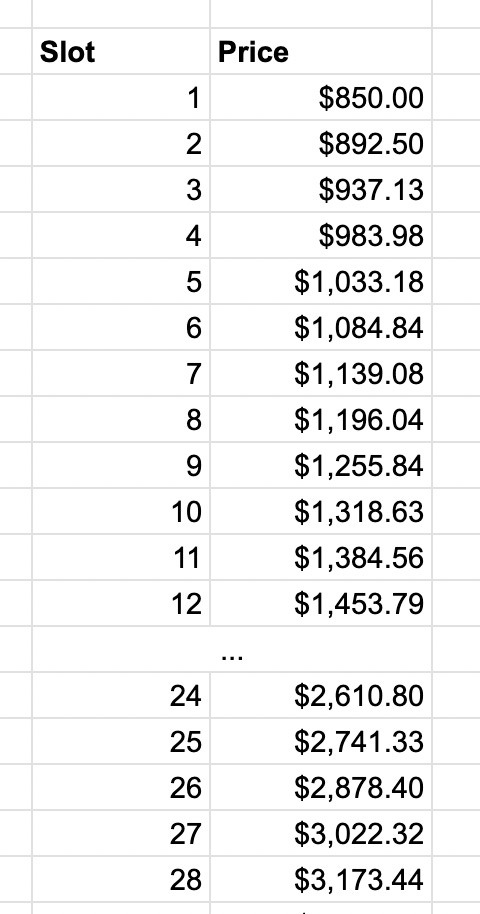

Here's how it works: the nth student to sign up pays 850 * 1.05^(n-1).

So, the first signup pays $850, the second pays 850 * (1.05^1) = $892.5, the tenth pays 850 * (1.05^9) = $1,318.63 and so on. Here’s a chart with some examples:

Potential students fill out the form with the maximum slot they’d be happy taking, and I fill slots in order of form submission if the maximum slot on the form is at least as high as the next available slot. So, if 5 slots have been filled and the next form submission has an 8, I give them the 6th slot (and they pay $1084.84), but if it has a 3, I don’t give them a slot and move on to the next submission.2

My thinking:

Each marginal student is more expensive for me and Lighthaven (because of capacity constraints) and for the class as a whole (because it draws from a larger number of people’s attention; as the number of people grows, the marginal additional person is less costly per student but more costly total), so it makes sense to charge them more.

This setup encourages faster signups, which is pretty useful for planning purposes.

If there’s more interest than we have total space for, we can afford to upgrade the space (e.g. by doing some construction on short notice that would otherwise be financially infeasible).

Conditional on a bunch of people signing up, the value of the product is higher than I’d originally thought, and it makes sense to raise prices — this just builds in that price raise directly.

It’s interesting! I hope to learn something. I feel pretty uncertain about how this is going to go, which is fun.

I notice I find it surprising given all of the above that there aren’t more people out there using pricing schemes like this, which means there’s probably something I’m missing about why it doesn’t work. I’m excited to find out what that is!3

And bonus points if you can figure out a better pricing scheme that I should have used instead. Maybe something like this?

Sign up for the course

You can do that using this form. Doooo it.

Fractal Tech Hub Trading Bootcamp (September 2-5, NYC)

Fractal Tech Hub is a cool new space that’s part of the Fractal Collective, which includes Fractal (a decentralized network of apartments that many friends of mine call home), Fractal University (an improvised college with low cost classes), and Fractal Bootcamp (a 3-month, immersive coding bootcamp). Turns out you’re allowed to just build a robust and meaningful community if you want to, go figure.

Extremely normie pricing scheme

Earliest bird (by August 2): $850

Early bird (by August 17): $1150

Normal bird (by Bootcamp start): $1450

Sign up for the course

Here’s the form to use, you can do it, I believe in you.

Sample Schedule

All of this is subject to change, I have dictatorial control and make many decisions at the last minute, I reserve the right to use your time however I please between 10am-7pm Monday-Thursday, et cetera et cetera. Anyway here’s my best guess at what it will include:

Also a lot of what we cover will be influenced by the students, if people really want to learn about uh the process of becoming a Designated Contract Market regulated by the CFTC then we’ll talk about that, whatever.

Taking This Course Will Not Make You Rich Immediately or Probably Ever

Just to dash some hopes and dreams, here are some things this class will not do:

Make you good enough at trading that you will be able to turn around and beat sophisticated well-capitalized market participants as soon as the afterparty ends Thursday night

Meaningfully boost your resume above the bar required to get a summer internship at your choice of quantitative trading firm (it’s a four day open admissions bootcamp, c’mon)

Help you find God

Here are some things this class might do:

Demystify what quantitative trading really is, what does that job involve, what skills are important for succeeding at it

Help you figure out whether you’re any good at it and whether you enjoy doing it

Introduce you to a really fun, ambitious, inexhaustible cohort of people who you might hang out with or even partner with on projects in the future

It might make you rich in the non-causal sense that conditional on taking the class, you’re somebody with free time and at least some disposable income, which puts you near the top of the global wealth lottery, and likewise someone who takes this course is way more likely to get a job in quantitative trading than somebody who doesn’t, but as far as I can tell it’s selection effects all the way down. I do know one person who locked down a trading job4 less than 72 hours after finishing the bootcamp and claims it was an essential link in the causal chain due both to what he learned and to gaining the confidence to apply to the job — I’m skeptical of the first part, he was already great at trading and prediction markets when he walked through the door, but if bootcamp helped his ego enough to apply I’ll gladly take half credit.

FAQ

What level of coding knowledge/ language do you need to know or order to benefit from the course?

Pretty minimal, the first two days involve zero coding and the third and fourth have more but we intentionally put you on pairs/teams that are balanced so that even if someone doesn’t have programming skills they can still contribute and learn. I think people with some programming knowledge will benefit a little bit more from the course but not very much.

What level of mathematics does one need to know?

There’s basically no content prerequisites, in that the bootcamp won’t use calculus or linear algebra or anything, but being a person comfortable thinking in mathematical frameworks - in particular the concept of expected value / probability - is pretty important. A lot of trading is about fast heuristic reasoning instead of having precise or sophisticated mathematical models, but those heuristics are still shaped by mathematics intuitions. If you’re “not a math person” it’s likely going to be a bad fit, but if you’re “into math but haven’t taken high level classes yet” that’s 100% fine and common.

Is housing provided?

It’s not included in the cost, but you can book rooms at Lighthaven here if desired. People might also try to coordinate housing via the Discord server.

What are the demographics of attendees?

A range: most are between jobs, a handful with experience in software engineering, some with experience in finance but not in trading specifically, some currently in college or recent graduates.

Is there any certification?

Nope. For what it’s worth, I think most firms view those things as bullshit anyway, and the ones that do care about it aren’t that good. The quality firms basically only care about raw intelligence and ability to solve problems on the fly.

Testimonials That Make Me Look Good

Obviously these are adversely selected for being positive feedback, as always you should be vigilant and suspicious about what I’m leaving out, do your own research, et cetera

“Amazing content, loved how fast paced it was. I learned an insane amount… I would pay to take any class you are excited to teach.” - Case

“Fantastically dense and effective communication, very well planned examples, lots of good jokes. I like every time you let us fall into a trap, [REDACTED] was everyone's favorite class I'm sure.”

“Listening to Ricki talk makes me feel like my brain is kicking into higher gear, she has an incredible effect on the audience.” - Chris

“You can definitely make a religion out of this.” - Andrey

“The way Ricki teaches the trading bootcamp is extremely engaging and information dense on material you won't find outside of big trading firms. It is a phenomenal experience that you will not find elsewhere.” - Niko

“Ruthlessly efficient learning, with feedback in real-time. Prepare for information density that'll rewire your brain.” - Niko again

“I want more Ricki. Blog posts? Podcasts? Videos? I'll take anything.” - Even more Niko, the guy gives great quotes

“if you can figure out a way to make money from this then go for it”

“Ricki is a fun, effective instructor. Talks at a million miles an hour, takes all questions and new constraints in stride and does something reasonable in response… the Electronic Trading Competition was glorious, relentless chaos.” - William

“Ricki has a lot of good qualities and none of them are subtlety” - Avital

“When you’re learning all the ways you can be abused in markets, you want to have a teacher as fun, engaging, and smart as Ricki.” - Rai

“felt too chaotic”

In particular anyone who worked on the construction team in June 2023, especially anyone responsible for electrical and plumbing in the Aumann and Bayes buildings and the outdoor heating installation.

If you think this system isn’t incentive compatible, please let me know why! I’d love to be corrected.

Avital says “What? Obviously the reason nothing else is priced this way is nobody wants to do a math problem to buy a banana. People will pay more for a banana to get out of thinking about exponents. You are selling the one product where it makes sense to select for the top 0.1% weird-pricing-scheme-happy buyers.”

Technically the job offer came in 2.5 weeks later after due diligence

(this is not a serious comment; I am just here to give Ricki a hard time)

> Each marginal student is more expensive for ... the class as a whole (because it draws from a larger number of people’s attention; as the number of people grows, the marginal additional person is less costly per student but more costly total), so it makes sense to charge them more.

The problem is, none of this cost-to-other-students is reimbursed back to those students. Really, X% of the excess revenue over $850/student should be distributed back as a discount to all students.

I whipped up a quick sheet to demonstrate how this should work in practice: https://docs.google.com/spreadsheets/d/1epV-LfRr21ApdhGtvdpVkEBaS3FYdMsK72IeVYM4hD4/

I guess we're trusting you not to fudge the submissions :)

For example, say slots 1-10 are filled, Alice bids 12, then later Bob bids 11. A dishonest organizer might pretend Bob's bid came in first, so that instead of Alice getting slot 11 and Bob being out luck (per the stated algorithm), Bob gets slot 11 and Alice gets slot 12.